SR-22 Insurance Made Simple

.jpg)

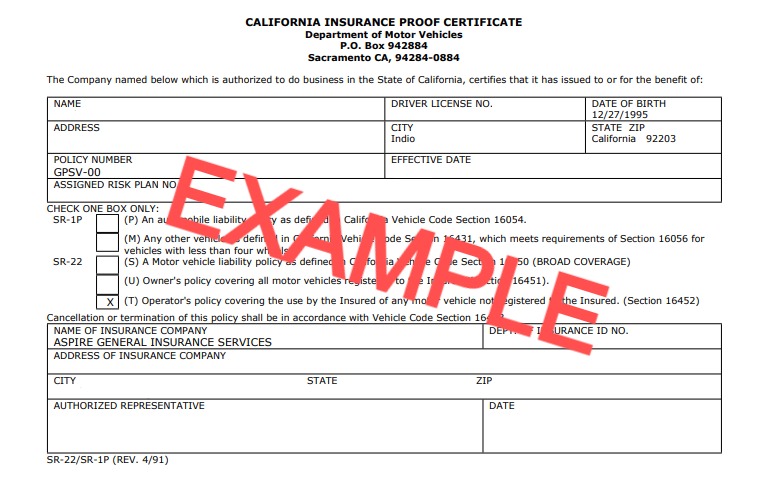

We specialize in helping high-risk drivers secure SR-22 insurance quickly and affordably. Whether you need an SR22 due to a DUI, license suspension, or accident, we’ve got you covered.

-

SR22 insurance isn’t a type of insurance but a certificate proving you meet your state’s minimum liability requirements. It’s often required for drivers with:

-

DUI/DWI convictions

-

License suspensions or revocations

-

At-fault accidents without insurance

-

Multiple traffic violations

-

-

The SR22 is filed by your insurance provider with your state’s DMV to verify coverage, typically for 3 years.

What is SR22 Insurance and Who Needs It?

Our Services

Why Choose Us for Your SR22 Insurance?

Our Services

How to Get SR22 Insurance in 3 Easy Steps

FAQ's:

-

Q: What is the cost of SR22 insurance?

-

A: The SR22 filing fee is typically $15–$50, but premiums vary based on your driving record, state, and provider. Get a quote to find the best rate.

-

-

Q: How long do I need an SR22?

-

A: Most states require an SR22 for 3 years, but this depends on your violation and state laws.

-

-

Q: Can I get SR22 insurance without a car?

-

A: Yes, non-owner SR22 insurance is available for drivers who don’t own a vehicle but need to maintain coverage.

-

-

Q: How quickly can I get an SR22 filed?

-

A: With SR22Savings, we can file your SR22 with the DMV in as little as 24 hours normally.

-

Frequently Asked Questions About SR22 Insurance

What Our Clients Say

5 Star Service is our priority!

.jpg)

Well, the agent spoke to me in a form that worked best for me. Example, through text message vs email or over the phone. Then when I had follow up questions, the agent addressed them just as soon as he could and got me the answers and the information that I need quickly.

Krystle - May, 2025

Very helpful, easy, convenient, and professional experience. Fast and friendly customer service.

Bryan - Mar, 2025

The process was quick and easy, prices were reasonable, and they didn't have any issues with DMV unlike a certain competitor.

Nick - Feb, 2025